“If you look at where the money is really held, it’s among the top 10 percent,” he said. “And if you break it down by age, race and education and parental education, you’ll see the disparities are even larger.” Parents who lack a four-year degree and, later on, their children are much less likely to have a direct stake in the stock market than college graduates; blacks and Hispanics are much less likely than whites.

“It’s too bad such a small percentage of the population has any real or meaningful ownership stake in equities, given their historic and current growth,” Mr. Boshara said.

Most households had less than $5,000 in total holdings in 2016, the most recent year analyzed by Mr. Wolff. Despite the slow recovery in housing prices, the wealth of middle-class Americans is still concentrated in their homes, which remain their single most valuable asset.

Newsletter Sign Up

Continue reading the main story

Thank you for subscribing.

An error has occurred. Please try again later.

You are already subscribed to this email.

For 9 out of 10 households, even a shift in value of 10 percent — enough to qualify as a “market correction” — would “at most, have a 1 or 2 percent impact on their wealth holdings,” Mr. Wolff said.

If anything, foreign multinational and other investors would feel more of a pinch, since they own 35 percent of all United States corporate stock, up from 10 percent in 1982. That share of the pie exceeds the single slice owned by taxable American shareholders, defined benefit plans, defined contribution plans, or nonprofit institutions, said Steven M. Rosenthal, a senior fellow at the nonpartisan Urban-Brookings Tax Policy Center.

Advertisement

Continue reading the main story

Don’t confuse the Dow with the economy.

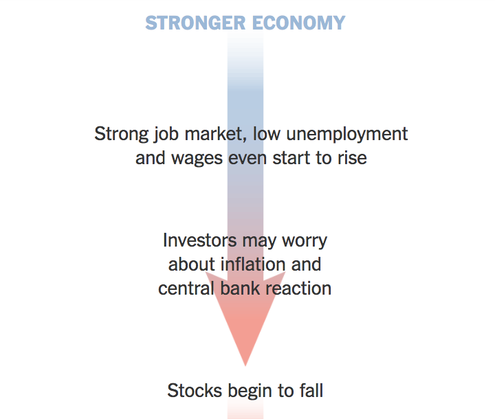

The stock market and the underlying economy are distinct. The two interact, but they do not proceed in lock step or even respond to each other in predictable ways. Certainly, market instability can undermine both consumer and business confidence and restrain spending and investment. And market bubbles, swelled by overextended borrowing, can explode, wreaking losses and stalling growth.

Still, valuations of assets and the country’s economic health — as determined by productivity, employment, investment, spending, housing values, production capacity, growth and more — are two different kettles.

The Stock Market Isn’t the Economy. Here’s How They Can Shape Each Other

Stock markets have recently fallen over fears that economic growth is too strong. Here’s why, and one way how steep, sustained sell-offs could end up hurting the economy.

“If all that happens is the stock market decreases or increases in value, but no real fundamentals change,” C. Eugene Steuerle, an economist at the Urban Institute who served in the Reagan administration, said, “then there are actually a lot of winners, not just losers.”

“Older people can buy less stock,” because the returns from their investment are smaller, Mr. Steuerle said, “but young people can buy more on the cheap,” which sets them up for bigger gains down the road.

“Attention, discount shoppers,” Michelle Singletary, a personal financial columnist for The Washington Post, advised on Thursday. “The recent stock market dive is like a holiday weekend sale.”

The economy still seems solid.

When it come to evaluating the economy’s fundamentals, assessments come in a Revlon rack of shades. Economists warn that mounting debt, as a result of the costly $1.5 trillion tax package, threatens economic stability over the longer run, as private investment is crowded out and interest payments balloon. Productivity growth is anemic and labor participation rates are low by historical standards.

Still, the signs of strength — at least for the next couple of years — are impressive.

Unemployment is near record lows, total output is rising at a faster rate, bond yields are up, oil prices have increased, and consumer and business confidence remain high. Every major economy around the world is growing in concert, simultaneously propelling and reinforcing a positive cycle.

After all, one of those indicators — a January jobs report that showed healthy payroll expansion and a jump in yearly wage growth — is what help set off the stock market tumult last Friday.

Continue reading the main story

Article source: https://www.nytimes.com/2018/02/08/business/economy/stocks-economy.html?partner=rss&emc=rss

Speak Your Mind

You must be logged in to post a comment.