“I love it,” said Ellen Zentner, chief United States economist at Morgan Stanley. “We saw a flood of job seekers into the market. We were able to create enough jobs to accommodate new seekers and keep the unemployment rate steady.”

Stocks were up nearly 1 percent in morning trading on Friday.

Job growth has been consistently strong in recent months. With revisions announced Friday, the monthly average job growth for February, January and December was 242,000. The labor force grew by 806,000, pushing the participation rate back up to the 63 percent mark. At the same time, other information released by the government this week showed initial jobless claims still near their lowest level in almost 50 years, suggesting layoffs are down and employers are trying to hold on to their workers. (Read more about signs that the economy is looking stronger and stronger.)

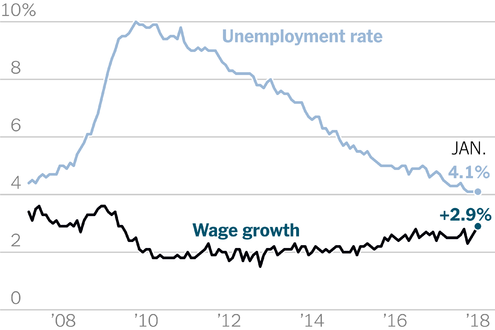

Although the drop in year-over-year wage growth to 2.6 percent is a bit disappointing to workers, the lower figure eased concerns about inflation. And as Ms. Zentner pointed out, “the upward trend remains in place.”

The jump in average hourly earnings in January — which pushed the year-over-year figure to 2.9 percent, from 2.3 percent just three months earlier — was cited as a cause of a market sell-off. (The January figure was revised down to 2.8 percent on Friday.)

That increase fueled inflation worries on Wall Street and speculation that the Fed might raise rates at least four times this year, rather than the three increases expected. “A strong jobs report with less wage inflation tells the market that current concern about the wage issue is overblown,” said Jonathan Golub, chief United States equity strategist at Credit Suisse. “The market has to think that is terrific.”

While some companies have prominently announced worker bonuses this year after the signing of the tax bill, those kinds of rewards — as opposed to pay raises — are not counted in the average hourly wage calculations by the Bureau of Labor Statistics.

February’s report is significant for another reason. With President Trump’s move to put tariffs on steel and aluminum imports and growing talk of a trade war, last month’s numbers could establish a baseline to measure the impact of trade restrictions and retaliation over the coming months. Manufacturing job gains, for example, totaled 31,000, more than twice the January figure.

Bidding for Workers

Corporate executives have long complained about the difficulty of finding workers, particularly in sectors like construction and trucking. Economists have generally reacted with skepticism, arguing that if there were really a shortage of qualified workers, companies would be raising pay to compete for talent. There are growing signs that this is at last the case.

Advertisement

Continue reading the main story

“For years and years, the trucking companies said they couldn’t find drivers, but they wouldn’t raise wages,” said Diane Swonk, chief economist for the accounting firm Grant Thornton. “Well, now they are.”

Newsletter Sign Up

Continue reading the main story

Thank you for subscribing.

An error has occurred. Please try again later.

You are already subscribed to this email.

Competition for drivers has become fierce. Ms. Swonk said she had heard reports of trucking companies paying drivers six-figure salaries, plus $20,000 signing bonuses to lure them from competitors. Companies are also offering to train new drivers — even though many end up being poached by other companies. “They’re still losing them to other places,” Ms. Swonk said.

As for the construction industry, Jed Kolko, chief economist at Indeed, an online recruiting site, noticed a significant increase in job postings over the past week without a corresponding response from applicants.

The sector has added 185,000 jobs over the past four months.

“It’s a good example of where demand on the employer side is going, but it’s not being matched by job-seeker interest,” he said.

The mismatch could grow significantly under Mr. Trump’s plan to encourage local, state and private investment in infrastructure. “If there is public interest in infrastructure, where do workers come from?” Mr. Kolko asked. “Does that end up bidding up construction wages and competing with other kinds of construction activity already underway?”

Retail trade employment increased by 50,000, suggesting that prospects in this low-skill sector are not quite as dire as some analysts have thought.

“Despite the slowdown in the year-over-year wage number, this was an incredibly strong jobs report with widespread benefits,” Mr. Kolko said. “Two of the most important household surveys were at their best level in almost 10 years,” he added, referring to a drop in the number of people who have been unemployed for more than half a year and the increase in the proportion of prime-age workers (25 to 54 years old) in the labor force.

“Today was remarkable,” he added. “It’s really hard to find any bad news.”

Graphic

6 Reasons That Pay Has Lagged Behind U.S. Job Growth

Average hourly earnings were 2.9 percent higher in January than a year earlier, a hopeful sign that wages might be gaining traction in a tight labor market. Their stubborn failure to do so is one of the mysteries of a recovery now in its ninth year.

Those Left Behind

In contrast to the multiple indicators of a tightening labor market, a persistent lack of employment among large numbers of working-age men continues to shadow the economy.

Advertisement

Continue reading the main story

Although large economic differences across regions have always been a characteristic of the United States, that gap appears to be widening instead of narrowing. In a paper published in the latest edition of the Brookings Papers on Economic Activity, the economists Benjamin Austin, Edward Glaeser and Lawrence H. Summers argue that the disparities are sharp among three regions: the prosperous coasts; the Western heartland, which has natural resources and higher education levels; and the Eastern heartland.

This last area, which extends from Mississippi to Michigan, generally east of the Mississippi and not on the Eastern Seaboard, is suffering from a glut of social and economic ills, including joblessness, disability, opioid-related deaths and rising mortality, the three Harvard University economists said.

“The income and employment gaps between three regions are not converging, but instead seem to be hardening,” they write. “America appears to be evolving into durable islands of wealth and poverty.”

Rather than moving to higher-income areas to take advantage of the increased employment opportunities, people remain stranded in areas that are economic dead ends. There are many theories about the cause, but rising housing costs certainly deter moving, as does the difficulty of transferring assistance like Medicaid across state lines.

A lack of employment is a greater problem than income inequality, they argue, citing evidence that suggests “misery haunts the lives of the long-term not working.”

Correction: March 9, 2018

Because of an editing error, an earlier version of this article misstated the most recent month in which job growth exceeded 313,000. It was July 2016, not October 2015.

Continue reading the main story

Article source: https://www.nytimes.com/2018/03/09/business/economy/jobs-report.html?partner=rss&emc=rss

Speak Your Mind

You must be logged in to post a comment.