Courtesy Ameriprise Financial

Courtesy Ameriprise Financial

It’s not just the recession that has set back Americans’ retirement savings, a new survey from Ameriprise Financial says.

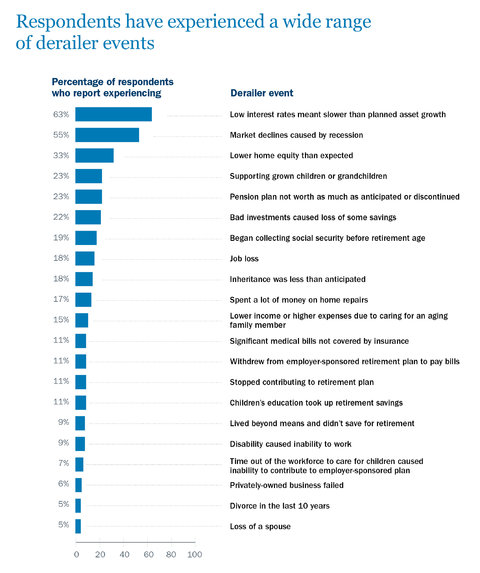

Asked about events that have “derailed” their retirement plans, many said personal events had affected their ability to save.

One fourth, for instance, said they were supporting a grown child or grandchild, and an equal proportion said their pension was not worth as much as they’d thought or had been discontinued.

“Expecting the unexpected is clearly more important than ever in preparing for retirement,” Suzanna de Baca, vice president of wealth strategies at Ameriprise Financial, said in a statement.

The survey was conducted for Ameriprise Financial by Koski Research, which surveyed 1,000 employed and retired adults, age 50 to 70, by telephone. All participants had assets of at least $100,000, including employer retirement plans, but not real estate. The margin of sampling error was plus or minus 3 percentage points.

The vast majority of older Americans who have saved at least $100,000 toward retirement have experienced some sort of “derailer,” whether an economic event or a personal one, that has affected retirement saving goals, the survey found.

The average survey participants said they had experienced four such events, which set back their savings plans by $117,000 on average. Nearly 37 percent of the participants said they had experienced five such events, costing them roughly $144,000.

The most-cited events were recession-related. For instance, nearly two-thirds of participants said low interest rates had affected the growth of their investments. More than half said their savings were significantly lowered by market declines, and a third said their home equity was going to contribute less to their retirement than they had expected.

As a result, only a third of participants said they were fully confident that they would be able to afford an unexpected expense, like a large home repair, in retirement.

When asked what they would do differently, more than half say they would have started saving earlier.

What sort of events have you experienced that have thrown off your retirement savings plans? How are you getting back on track?

Article source: http://bucks.blogs.nytimes.com/2013/05/15/why-retirement-savings-are-falling-short/?partner=rss&emc=rss