CATHERINE RAMPELL

Dollars to doughnuts.

In an article on Thursday’s front page, I wrote about how long job vacancies are taking to fill, especially when you consider the abundance of unemployed workers.

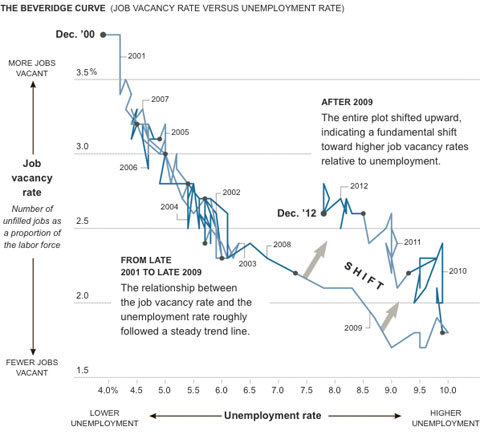

Economists have been thinking about this issue for a couple of years now thanks to a shift in what is known as the Beveridge Curve.

The New York Times Source: Bureau of Labor Statistics.

The New York Times Source: Bureau of Labor Statistics.

No, the Beveridge Curve is not about the relationship between Coke and Pepsi. It’s named for the British economist William Henry Beveridge, and it shows the relationship between the unemployment rate and the job vacancy rate.

In an economic expansion, the jobless rate is low and the job vacancy rate is high; a small share of workers are looking for jobs, and so when employers post a vacancy, the opening can be hard to fill. Or you can think about it the other way — if there are a lot of jobs available, then people will not have much trouble finding work, leading to low unemployment.

In a recession, the reverse is true: there is a high unemployment rate and a low vacancy rate. Where you end up on the curve generally depends on where you are in the business cycle, but you will probably be somewhere on or near that line.

Since late 2009, the curve has shifted outward. That means that even if the job market is not exactly booming, there are more vacancies out there than the unemployment rate alone would have predicted a few years ago.

The million-dollar question is: Why?

There are probably a few forces at work.

One is skills mismatch — that is, the workers who are pounding the pavement do not have the skills that employers actually want.

This is probably true for some highly coveted occupations that require specialized skills, like nursing or engineering. After the housing bust and financial crisis, there was a structural decline in industries like construction, and the skills and credentials required for construction work do not directly translate to working in a hospital or at Google.

In addition, there are now a lot of long-term unemployed workers whose skills may have deteriorated. Maybe some are not currently fit for any job, even in the industry or occupation in which they last worked. Or maybe employers just assume this, keeping the long-term unemployed stuck that way no matter what they do.

Still, this can’t be the whole story. If there were a shortage of qualified workers across a lot of industries, you would be seeing employers bid up wages for the few candidates who were desirable. That does not appear to be happening.

Another explanation may have to do with whether all those who are calling themselves unemployed today would have been counted as unemployed in the past. In recent years, jobless-benefit eligibility has been longer than at any previous time in American history, with some workers qualifying for as long as 99 weeks. That longer duration of benefits could be inflating the unemployment rate.

“Some workers, though not the majority, who are unemployed are unemployed in name because they have to go through the motions of going through the job application process in order to remain eligible for unemployment benefits,” said Steven J. Davis, an economist at the Booth School of Business at the University of Chicago who has constructed models for vacancy duration and recruiting intensity. In the past, these people probably would have dropped out of the labor force much earlier, bringing the unemployment rate down.

This should be less true now that the duration of benefits has become shorter and millions of workers have exhausted their weekly checks. There are about 800,000 people who want jobs but have given up looking because they are discouraged, which means they are not officially counted as unemployed. Excluding them makes the official unemployment rate lower than it would otherwise be (although presumably in previous recessions there were also people who gave up looking for work).

Finally, we get to the explanation I focused on in the front-page article: that employers have vacancies but are afraid to fill them because of economic and policy uncertainty.

Maybe sales growth will drop off, they worry. And because of Congressional gridlock, employers are still unsure what is going to happen to government spending and federal tax rates. Many businesses also remain confused about how the Affordable Care Act will affect them.

“They’re taking longer to fill vacancies because they just feel less need to fill jobs now,” Professor Davis said. “They recognize that in a slack labor market there is an abundance of viable candidates. If something happens, and if they need to hire quickly, they know they can do that. That’s harder in a tight labor market.”

As a result, some companies are keeping job postings up for months, if not years, and putting candidates through round after round of interviews without hiring anyone. For some companies, the only candidate who can justify the risky expense of filling a vacant position is a candidate who is unimaginably overqualified.

“I saw a posting for a job recently vacated by someone I knew,” one unemployed reader, who did not want his name revealed, wrote me in response to the article. “I’d worked closely with this person and she had done an excellent job. She was missing about half the things they were now looking for.”

Article source: http://economix.blogs.nytimes.com/2013/03/07/an-odd-shift-in-an-unemployment-curve/?partner=rss&emc=rss