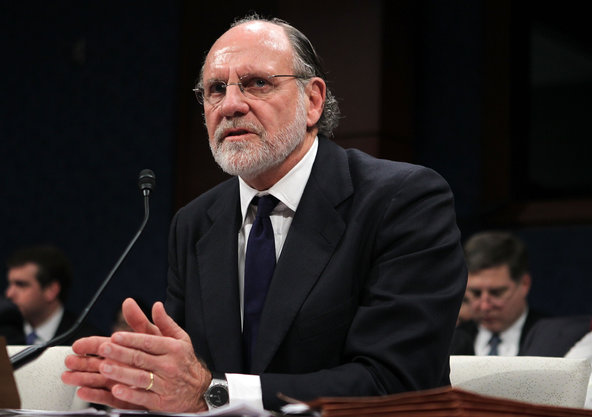

Alex Wong/Getty Images Jon S. Corzine, former chairman and chief executive of MF Global.

Alex Wong/Getty Images Jon S. Corzine, former chairman and chief executive of MF Global.

7:23 p.m. | Updated

A bankruptcy trustee has sued Jon S. Corzine and other former MF Global executives, claiming they were “grossly negligent” in the lead-up to the brokerage firm’s collapse.

The action by the trustee, Louis J. Freeh, comes just weeks after he agreed to postpone the lawsuit and enter mediation with Mr. Corzine. By filing litigation that appeared to catch the MF Global executives off-guard, Mr. Freeh may have jeopardized those talks.

“We question why the trustee chose to file this lawsuit, which is filled with seriously flawed allegations, while he is participating in court-ordered mediation of these very claims,” said a spokesman for Mr. Corzine, Steven Goldberg.

Mr. Freeh, who represents hedge funds and other creditors of MF Global, said on Tuesday that “the mediation process is ongoing,” and that it was “in the best interests of the Chapter 11 estates to file the complaint.”

Related Links

The lawsuit, filed in United States Bankruptcy Court for the Southern District of New York late on Monday, echoes a report Mr. Freeh issued this month that blamed MF Global executives for engineering a “risky business strategy” and ignoring “glaring deficiencies” in internal controls. The report and the lawsuit accuse the executives of allowing more than $1 billion in customer money to disappear from the firm.

In the new complaint, Mr. Freeh took aim at Mr. Corzine, a former Democratic senator and New Jersey governor who became MF Global’s chief executive in 2010. Mr. Freeh, a former director of the F.B.I., also sued two of Mr. Corzine’s top deputies: Bradley I. Abelow, the chief operating officer, and Henri J. Steenkamp, the chief financial officer. Mr. Freeh labeled the men as “Corzine’s handpicked deputies.”

“Defendants, in their capacities as officers, breached their fiduciary duties of care, loyalty, and oversight over the company, and failed to act in good faith,” Mr. Freeh wrote.

The action against Mr. Abelow and Mr. Steenkamp is unusual in that both executives remained at MF Global for more than a year after the firm’s collapse, working under Mr. Freeh. They stayed to help sort through the bankruptcy process.

Gary P. Naftalis, a lawyer for Mr. Abelow, noted that Mr. Freeh had himself described that work as “invaluable.” Mr. Naftalis criticized Mr. Freeh for “now making allegations that lack any factual or legal basis.”

Mr. Goldberg, the spokesman for Mr. Corzine, also said the assertions in the suit were unsubstantiated. “There is no basis for the claim that Mr. Corzine breached his fiduciary duties or was negligent,” he said. “We look forward to proving the actual facts in court.”

The suit, which could help Mr. Freeh recover money for MF Global’s creditors, blamed Mr. Corzine for ramping up a risky bet on European debt. While the bonds were not by themselves to blame for the collapse of MF Global, the wager unnerved its investors and ratings agencies, further undermining the firm.

“Corzine engaged in risky trading strategies that strained the company’s liquidity and could not be properly monitored by the company’s inadequate controls and procedures,” Mr. Freeh said.

Mr. Goldberg in turn called the complaint “a clear case of Monday morning quarterbacking.” Mr. Corzine, he said, inherited a firm in 2010 that had lost money in each of the previous three years.

It is unclear whether the lawsuit will alter the mediation talks. While Mr. Freeh said the discussions were continuing, the lawsuit could derail or delay the mediation process.

The litigation might also complicate an effort to return money to customers. Mr. Freeh pursued his own case against Mr. Corzine, rather than join an earlier lawsuit filed by a second MF Global trustee, James W. Giddens, and some of the firm’s customers. Mr. Giddens, who has the task of recovering money for the customers, has already returned about 89 percent of the shortfall to MF Global’s clients in the United States. Some people close to the case say Mr. Giddens has identified a path to potentially making customers whole.

The lawsuit, coming on the heels of a bankruptcy judge approving Mr. Freeh’s plan to liquidate MF Global, could empower him to recover additional money for creditors. But the case might not sit well with customers.

In a statement, Mr. Giddens said he had joined the customers’ class-action lawsuit “because it was the most efficient way to get money to customers and creditors.”

Federal authorities, including the Commodity Futures Trading Commission, also continue to investigate the misuse of customer money. Mr. Corzine has not been accused of any wrongdoing by the agency, and internal e-mails suggest he was not aware that at least some of the customer money was improperly sent to the firm’s banks.

“Anyone who violates the law, and particularly anyone at MF Global who used a billion bucks of customer cash that should have been protected, should be punished appropriately,” said Bart Chilton, a member of the trading commission.

This post has been revised to reflect the following correction:

Correction: April 23, 2013

An earlier version of this article misstated when Lehman Brothers collapsed. It was 2008, not 2012.

Article source: http://dealbook.nytimes.com/2013/04/23/mf-global-trustee-sues-corzine-over-firms-collapse/?partner=rss&emc=rss