Eric Rosengren, the president of the Federal Reserve Bank of Boston, made a compelling case on Friday morning that the Fed’s dual mandate doesn’t really matter.

That was not the point of Mr. Rosengren’s talk. He set out to defend the unusual operating instructions that require the Fed to seek maximum employment in addition to the standard focus of a central bank, maintaining price stability.

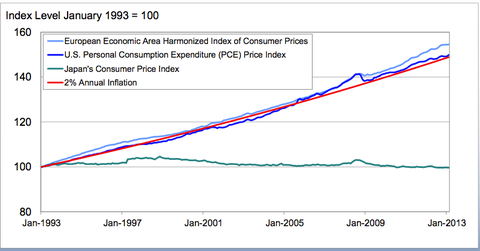

In particular, he argued that over the last 20 years, the Fed has controlled inflation more successfully than central banks that operated under a single mandate. The chart below shows the Fed has held price inflation close to the 2 percent annual pace that the Fed, like most other central banks, regards as most healthy.

Source: Eurostat, Bureau of Economic Analysis, and Japanese Ministry of Internal Affairs and Communications, via Haver Analytics

Source: Eurostat, Bureau of Economic Analysis, and Japanese Ministry of Internal Affairs and Communications, via Haver Analytics

So, the Fed is pretty effective at controlling inflation. The dual mandate doesn’t seem to be doing any harm. But it doesn’t seem to be doing much good, either.

As Mr. Rosengren put it, over the last two decades, “the U.S. has a tighter inflation range and a broader unemployment range than many other countries with a single inflation mandate.” In other words, countries with single-mandate central banks have seen less fluctuation in unemployment rates than the United States.

The last few years offer the most striking example. Inflation has remained at or below the Fed’s 2 percent target, while unemployment has remained far too high.

Mr. Rosengren and other Fed officials argue that the central bank is doing what it can to increase the pace of job creation. But those efforts have proved insufficient in part because the Fed’s 2 percent target limits the amount by which it can cut interest rates during a downturn, and it has run out of room. As a result, the Fed has turned to less effective tools to stimulate the economy, like asset purchases.

We don’t know, of course, how the Fed would have behaved under a single mandate. Perhaps it would have acted less forcefully to reduce unemployment. And comparisons with other central banks, and other countries, go only so far because monetary policy is only one factor that influences changes in unemployment.

Perhaps Mr. Rosengren is right to argue that “a dual mandate may help to ensure that employment gets an appropriate weighting in the central bank’s assessment of appropriate policy, particularly during times when employment ranks first in terms of economic woes.”

But it’s hard to find the evidence.

Article source: http://economix.blogs.nytimes.com/2013/04/12/the-impact-if-any-of-the-feds-dual-mandate/?partner=rss&emc=rss