But there is more strategic vision than is immediately evident. The plan to starve the beast of government by depriving it of money, it seems, is back in the saddle. This time around it might succeed where Reagan failed: Barring taxpayers from deducting state and local income taxes and limiting the property taxes they can deduct on their federal returns, the Republican bills could, for the first time, force high-tax states run by Democrats to capitulate.

Graphic

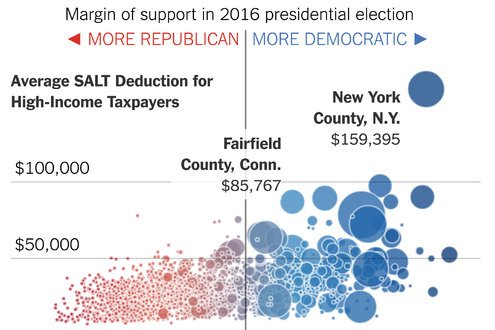

Among the Tax Bill’s Biggest Losers: High-Income, Blue State Taxpayers

High earners in Democratic counties are the most likely to receive a tax increase as a result of the repeal of the state and local tax deduction.

Excluding payroll taxes — which pay for Social Security and Medicare — federal tax revenues declined to 11.2 percent of gross domestic product in 2016 from 12.1 percent in 1980, when Reagan was elected, according to the Organization for Economic Cooperation and Development, a policy group of industrialized nations. That is a difference worth some $170 billion a year, in today’s money.

This bucks the trend among the rest of the countries in the group, with central government revenue increasing by about two percentage points of G.D.P., on average. But it also rows against the current of states and municipalities in the United States. From 1980 to 2016, state and local revenues increased to 8.5 percent of G.D.P., from 7.8 percent, the O.E.C.D. says — a rise worth $130 billion a year.

If the Republican bills become law, states and municipalities are going to need the money. Slashing revenues by about $1 trillion over 10 years, according to the latest estimates by Congress’s Joint Committee on Taxation, the bills create enormous pressure to cull federal spending.

That alone will call on states to fill the gap. “A lot of responsibility for social programs is going to shift to the states,” said Kim S. Rueben, director of the state and local finance initiative at the nonpartisan Urban Institute. This doesn’t apply only to, say, New York or California — states with higher taxes funding more generous social programs. It applies to Mississippi, a poor, low-tax state that provides very little in social insurance and relies heavily on the federal government to provide a safety net.

But if the state and local deduction disappears, the task will become that much more difficult. In 2013, almost six million taxpayers in California used the state and local tax deduction, deducting an average of $16,420, according to the nonpartisan Tax Policy Center. In New York, over three million taxpayers claimed $20,489, on average. Eliminating the benefit will make it increasingly difficult for these states to raise money.

“This is one of the more strategic efforts in the starve-the-beast mode,” said Lawrence F. Katz, a professor of economics at Harvard. “Nobody can be a blue state anymore. They are going after the flexibility of states to do things.”

Advertisement

Continue reading the main story

Indeed, Republicans’ new tax proposals seem to be taking the country a few decades back.

Think about unemployment insurance. It didn’t exist until 1935, when the Great Depression inspired Congress to write it into law, funded by a levy on businesses and granting states great leeway in carrying out the program. But states had been talking about it for two decades, and seven had already passed unemployment insurance provisions when Congress got involved. “This is the best example of the laboratory of democracy,” said Claudia Goldin, an economic historian at Harvard.

The state-level experimentation that led to the creation of federal unemployment insurance is what the nation stands to lose.

This is not to say that the state and local tax deduction is the ideal mechanism to bolster the finances of state and local governments. It is loaded heavily to benefit the rich, who pay the highest federal tax rates and are the most likely to itemize their deductions.

It is unclear, moreover, to what extent the provisions in the Republican bills will, in fact, hinder state finances. Eliminating the deduction for state and local income taxes raises their “price” for taxpayers: Those paying a top federal rate of 35 percent get 35 percent off their state and local contributions. But the Republican bills — which still have to be mushed together into one piece of legislation — do other things, too.

Newsletter Sign Up

Continue reading the main story

Thank you for subscribing.

An error has occurred. Please try again later.

You are already subscribed to this email.

They expand the standard deduction, so fewer people will itemize their deductions in the first place. They also pare back the alternative minimum tax, which prevented some taxpayers from benefiting from the state and local deduction. Both these provisions could mute the effect of the changes in deductibility.

“This will mitigate the effect in some ways,” Ms. Rueben said. “But it won’t eliminate it.”

Today, it seems inevitable that the federal government will shrink into an earlier version of itself. As Professor Goldin noted, it looks a bit the way it did in the early years of the 20th century, when the government had little money to pay for social policy.

“States were the only place where social policy could be conceived of,” she told me.

Republican efforts to starve the beast imagine state governments falling in line with federal austerity. But as wages stagnate and inequality widens, as Americans fall prey to death by opioid addiction, that seems at odds with what the moment calls for.

Continue reading the main story

Article source: https://www.nytimes.com/2017/12/05/business/economy/tax-plan-reagan.html?partner=rss&emc=rss

Speak Your Mind

You must be logged in to post a comment.