What makes this particularly puzzling for scholars reared on the classical models of competitive economies is that all this happened despite a persistent decline in real interest rates. In a more orthodox economy, declining rates on corporate bonds would encourage a surge in corporate investment. As companies invested more and more capital, the returns on investments would gradually decline until companies’ returns matched their cost of capital: the interest rate they pay to borrow.

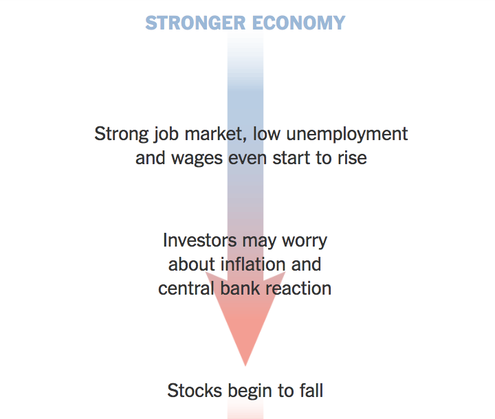

The Stock Market Isn’t the Economy. Here’s How They Can Shape Each Other

Stock markets have recently fallen over fears that economic growth is too strong. Here’s why, and one way how steep, sustained sell-offs could end up hurting the economy.

In the United States, neither has occurred. Investment has been stuck at stubbornly low rates. And even as interest rates have fallen, the average return on productive capital has stayed roughly constant.

In a nutshell, the United States has built an economy where businesses don’t invest even though it has rarely been cheaper to finance investment. Still, they reap spectacular profits that warrant runaway share prices.

“These are not your father’s growth facts,” wrote Gauti Eggertsson, Jacob A. Robbins and Ella Getz Wold of Brown University in an analysis published this week by the Washington Center for Equitable Growth. The puzzling facts of contemporary America suggest an economy poised to fail.

What happened? It turns out that there is one straightforward reason for the American economy’s unorthodox behavior. As Mr. Eggertsson and his colleagues argue, the standard economic theory based on competitive markets cannot apply when markets are not competitive. And competition, in the United States, is shriveling.

The scholars argue that the American economy is afflicted by “rents” — returns in excess of what investments would yield in a competitive economy, where fat margins are quickly whittled away by competition.

These rents don’t fall from the sky. Companies free of competitive pressures, with the power to set prices more or less at will, squeeze them from their customers and their workers. They pad corporate profits and send stock prices sky high.

Graphic

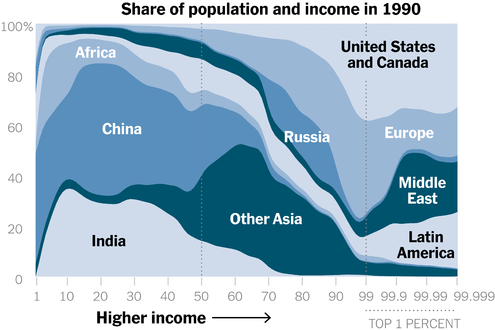

It’s an Unequal World. It Doesn’t Have to Be.

Global inequality, after widening for decades, has stabilized. The share of the world’s income captured by the top 1 percent has shrunk since its peak on the eve of the financial crisis.

Executives love it. The critical question is what these rents hold in store for the rest of us.

This doesn’t necessarily mean, by the way, that the corporate landscape has been taken over by evil monopolists that resort to illegal tricks to keep competitors out. High-tech titans like Google and Facebook may just have the ability and the deep pockets to out-innovate everybody — delivering wonderful new experiences to consumers along the way, and maintaining monopoly control over their latest innovations. One intriguing theory is that the globalized economy is reorganizing the business landscape, encouraging the rise of corporate superstars.

Advertisement

Continue reading the main story

Not everybody agrees that competition is waning. Hal Varian, Google’s chief economist, argues plausibly in a recent study that the case to worry about market concentration across the economy is weak. Even as concentration has increased in many sectors, there is plenty of competition in most industries and markets. Carl Shapiro, an antitrust scholar from the University of California, Berkeley, who served in President Barack Obama’s Justice Department, worries that the new populism infecting American politics could prompt antitrust policy to take aim at all big successful companies.

Newsletter Sign Up

Continue reading the main story

Thank you for subscribing.

An error has occurred. Please try again later.

You are already subscribed to this email.

Still, there are good reasons to worry about rising rents, no matter where they come from. Mr. Shapiro argues that while some measures of market concentration may not be meaningful, persistently high profits are of themselves a cause for concern.

Profits as a share of output have risen by half over the last 30 years. Combined with evidence that large corporations are accounting for an increasing share of revenue and employment, Mr. Shapiro writes, “it certainly appears that many large U.S. corporations are earning substantial incumbency rents, and have been doing so for at least 10 years, apart from during the depths of the Great Recession.”

This is particularly true in the tech sector, where a handful of dominant companies — you know the ones I’m talking about — have sustained spectacular profits for years. Their sky-high stock prices suggest that investors expect high profits to continue as well.

“They probably are geniuses; what they are doing is wonderful,” Mr. Shapiro told me. “Still, you would expect competition to erode away the excess profits over time.”

Here is why we should worry.

Mr. Eggertsson and his colleagues built an alternative model of the American economy by doing away with the assumption of perfect competition. They contend that there are barriers to entry that stop competitors and allow rents to persist.

In this economy, stock prices don’t just reflect the future stream of normal economic returns that would accrue to a company’s capital investment. They also include a claim to a stream of rents that generate “pure profits.” These profits can’t be replicated by another company’s capital investment. They are owned by a specific company.

So what features might an economy like this possess? Wages are unlikely to rise much in a job market dominated by a few big employers. As I speculated last week, markets dominated by a few businesses will most likely deter start-ups from appearing on the scene.

Advertisement

Continue reading the main story

Rising rents will take larger shares of the nation’s income. That will bolster the proportion of income that goes to corporate profits but squeeze the share that flows to workers — in wages and benefits — and to productive capital. This will discourage both work and capital investment. It will weigh on overall economic growth.

Rents interfere with incentives in a big way. Companies will spend more time and effort trying to preserve those rents — often by working to block rivals from their markets. Rivals will fight to grab a share of those rents for themselves, perhaps through lobbying. Amid all this jockeying, investment in productive capabilities will most likely be neglected as a secondary consideration.

And inevitably, inequality will rise: The owners of the shares in the powerful corporations capturing the economy’s growing monopoly rents will peel further and further away from the average Jane and Joe, who own little but their labor.

This is not the kind of economy proposed by classical economic theory. It is not the kind of country portrayed by evangelists of the American dream. But it looks as if we are stuck with it, regardless of what the stock market does tomorrow.

Continue reading the main story

Article source: https://www.nytimes.com/2018/02/13/business/economy/profits-economy.html?partner=rss&emc=rss

Speak Your Mind

You must be logged in to post a comment.