Carl Richards is a certified financial planner in Park City, Utah, and is the director of investor education at The BAM Alliance. His book, “The Behavior Gap,” was published this year. His sketches are archived on the Bucks blog.

I recently attended a varsity soccer game at the local high school in Park City, Utah. It was the quarterfinals of the state tournament. At the end of regulation the game was tied, which meant overtime. After overtime, the game was still tied, which meant a shootout.

A shootout is when each team gets five penalty kicks, and the team with the most scored goals wins. For those of you not familiar with soccer, let me explain. A penalty kick is when a stationary ball is placed 12 yards from the goal line, leaving just the kicker and the goalkeeper.

It’s a tough and intense way to end a game. Because the ball is so close, and the goalkeeper can’t move before the ball is hit, the goalkeeper has almost no time to react. So the strategy has always been for the goalkeeper to pick a side and dive. The choice of which side to dive to is made without having a chance to read the ball — there just isn’t enough time.

Of course, there is a third option: stand in the middle. As I watched the goalkeepers dive, I was reminded of when I played over 20 years ago. We did the same thing then, too. In fact, I remember thinking, “If they’re going to dive, why risk going wide by aiming for the corners? Just kick it hard right down the middle because the goalkeeper won’t be there.”

A few of the players this weekend in Park City had the same idea. Kick the ball straight down the middle while the goalkeeper dives heroically to the side.

In an odd coincidence, a few days later I learned of a study focused on decision making and penalty kicks. The analysis covered close to 300 penalty kicks. It looked at both the goalkeepers’ decision in terms of where they chose to dive, as well as where the ball was actually kicked.

As it turns out, the goalkeeper picks a side and dives 93.7 percent of the time and just stands in the middle only 6.3 percent of the time. There was a clear bias toward action. The kicks themselves are more evenly spread across the net, and here’s the clincher: Almost 30 percent were kicked to the middle of the net. Without boring you with the numbers, the result showed that goalkeepers could almost double their save percentage by doing nothing. In other words, just standing there was the optimal strategy.

What goalkeeper is going to do that? Can you imagine how silly that would look? Everyone is expecting action. Every other goalkeeper in the world dives to a side of the goal. Just standing there would be embarrassing.

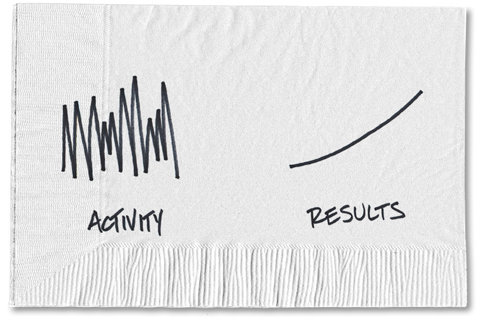

We do the same thing with investing.

We all know that once you build a low-cost, diversified portfolio, you should avoid making changes every other day. We’ve heard Warren Buffett say things like, “Benign neglect, bordering on sloth, remains the hallmark of our investment process.”

We know that time in the market is the key, not timing the market.

Despite all that, we often chose to do something instead of just standing there. According to Dalbar’s 2013 Quantitative Analysis of Investor Behavior, the average time we hold a stock mutual fund — by definition a long-term investment — is just less than three and a half years. I know three plus years may feel like a long time, but seriously? On top of that, we now have people talking about how great exchange-traded funds are, often citing that they’re low cost (good) and that you can trade then any second of any day (shouldn’t matter).

It’s all a bit crazy. But we feel that we must do something with our investments for the same reason a goalkeeper dives.

Everyone else is moving, trading, talking. Why not us? It’s what investing is all about, right?

Wrong.

That is called entertainment. If you want a term to justify it, you can call it trading. But the evidence is clear that it doesn’t work. So this is one of those rare opportunities to improve your results by being lazy. Build a portfolio that matches your goals, and forget about it.

Maybe for years.

Try it. If you have a well-diversified portfolio, just try doing nothing for a month, and then two, and then three. Start an “I’m doing nothing streak.” See how long you can make it. In fact, go one step more and practice Mr. Buffett’s strategy. Learn to feel good about benign neglect. Brag about the fact that you have no idea where the market is, and you haven’t even looked at your investments for a long time.

And yeah, on top of giving you something to talk about, not to mention gaining a lot of time and energy back, your results will probably be better, too.

Doing nothing may be one of the best decisions you ever make.

Article source: http://bucks.blogs.nytimes.com/2013/05/13/in-soccer-and-investing-bias-is-toward-action/?partner=rss&emc=rss

Speak Your Mind

You must be logged in to post a comment.