Earlier, the Nikkei index in Japan closed down 1.29 percent, while the Kospi index in South Korea ended down 1.10 percent. European stocks were also lower, with London down 0.56 percent and Frankfurt down 1.12 percent.

Prices of United States Treasury securities — often in demand in times of turmoil — rose early in the day, driving their yields, which move in the opposite direction, lower. But Treasury prices gave up ground in the afternoon, and the yield on the benchmark 10-year Treasury note slipped to 2.25 percent, from 2.26 percent on Tuesday.

Gold futures rose 1.59 percent, to $1,282.40 an ounce.

Gold tends to outperform stocks when the markets are sliding, so it is unusual for such a conservative investment to beat equities when they have been on a tear as has been the case this year.

What is driving this anomaly, some say, is a recognition that eventually investors will not be able to ignore recent headline risks — whether nuclear tensions with North Korea, a trade war with China or a debt ceiling crisis in Washington.

“There has been a Pavlovian response by investors to disregard any piece of bad news or any spike in volatility, and that has been a very profitable strategy,” said Russ Koesterich, a portfolio manager for BlackRock’s $39 billion Global Allocation Fund. “But we do think that there are risks in the world that are not being priced in.”

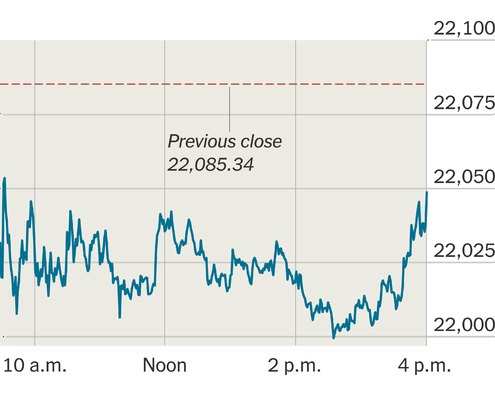

The Dow Minute by Minute

To Mr. Koesterich’s point, some of the best-performing investments in the world this year have been exchange-traded vehicles that investors can use to bet against the VIX, the Chicago Board Options Exchange Volatility Index, better known as Wall Street’s fear gauge.

The VIX rose nearly 9 percent on Wednesday after Mr. Trump’s comments about North Korea, before settling up just 1.37 percent, at 11.11 for the day. The index has been trading at historically low levels, and many investors continue to wager that lots of money pouring into markets and an improving global economy will keep the index quiescent.

Advertisement

Continue reading the main story

Mr. Koesterich, however, has been taking the opposite side of that trade. Since the beginning of the year, he has been adding to his gold position, and it is now the Global Allocation Fund’s second-largest position, according to Y Charts.

Newsletter Sign Up

Continue reading the main story

Thank you for subscribing.

An error has occurred. Please try again later.

You are already subscribed to this email.

“Gold can help especially if the dollar is not a safe haven anymore,” he said, referring to how the dollar has weakened in response to the spate of news from Washington. “It is a good headline hedge.”

Mr. Koesterich is not alone in adopting a wary stance, especially now in August, when trading desks on Wall Street empty out and lower levels of buying and selling can result in sharper downward moves in the market.

While few people are predicting an actual crash, a growing number of stock market specialists are warning that in the coming months, markets are likely to start reacting more to so-called macro events such as political volatility and the realization that central bankers in Europe and the United States are moving toward a more restrictive stance on interest rates and intervening in markets.

That is because the benign market conditions of recent months have been spurred by better economic news, and, in particular, by a very good spate of second-quarter earnings.

Once investors return from vacation, the theory goes, and with no good earnings news to inspire them, they will be more sensitive to headline events.

That could result in sharper moves downward in stock market indexes.

“There are risks,” said Marko Kolanovic a market strategist and derivatives specialist at JPMorgan Chase, who warned in a recent report about an increase in trading volatility this fall. “China, North Korea and the normalization of policies by central banks, which has been underappreciated by the market.”

Since 2012, after a sharp rise during the financial crisis, gold, as an investment, has not performed well as investors have chased returns in buoyant stock and bond markets.

But while many investors have shaken off scares such as Britain exiting the European Union or political unrest in Washington, the view is taking hold that gold can be a very good hedge against more serious threats like nuclear confrontation in Asia.

“There has been a wall of money supporting markets so far,” said Stuart Culverhouse, a market strategist at Exotix Capital in London. “But this time we are not just talking about a macro surprise — we are talking about full-on military action.”

Continue reading the main story

Article source: https://www.nytimes.com/2017/08/09/business/dealbook/stock-markets-investor-caution.html?partner=rss&emc=rss

Speak Your Mind

You must be logged in to post a comment.