Jared Bernstein is a senior fellow at the Center on Budget and Policy Priorities in Washington and a former chief economist to Vice President Joseph R. Biden Jr.

In making the critical connection between high inequality and diminished mobility, I’ve often cited the work of economist Miles Corak, who had a fine commentary on the topic in The New York Times on Sunday. I wanted to highlight a few key points but then spend a moment on his policy solutions, which struck me as inadequate.

Today’s Economist

Perspectives from expert contributors.

Professor Corak wrote about the increasingly robust opportunities available to the children of the wealthiest 1 percent of households relative to children from less privileged backgrounds, partly because of nepotism and networks. No news there, of course, but Professor Corak emphasizes that while this phenomenon is common across countries, the outcomes for children in other rich countries are less tied to their birth than they are for children here.

Part of that difference stems from the fact that policies to offset inequalities at the starting gate face far less aggressive opposition in other advanced economies. For example:

“Ontario, the most populous Canadian province, is introducing full-day kindergarten, accessible to all 4- and 5-year-olds, without fanfare or a hint of the kind of rhetorical rancor and calamitous opposition that the Obama administration has faced for its proposal to do the same.”

That’s a highly resonant observation. For years, economists of all political stripes have argued for quality preschool to counteract the extreme and lasting disadvantages faced by children who start life in poverty in this country, poverty that is far deeper in terms of material deprivation than in most other advanced economies. The lifelong impact of starting out under these difficult circumstances means that quality interventions have a high benefit/cost ratio to society. Yet to see how quickly and effectively the anti-government, anti-tax and anti-spending forces snapped into action the day after President Obama announced an idea like this in his last State of the Union address gives you a tangible and fearsome sense of the full spate of the barriers facing those disadvantaged children.

That’s where I thought Professor Corak didn’t go nearly far enough:

“The recipes for breaking this intergenerational trap are clear: a nurturing environment in the early years combined with accessible and high-quality health care and education promote the capacities of young children, heighten the development of their skills as they grow older, and ultimately raise their chances of upward mobility.”

Definitely necessary, and I appreciate the health care reference, but far from sufficient. It’s a common default for economists and policy makers to present a trenchant analysis of a problem with many deep roots and then conclude, “That’s why we need better education and skill development.”

The problem is that a central thesis of the inequality/mobility nexus is that skills alone won’t crack it. Again, no question that overcoming the barriers that block lower-income children from achieving their intellectual (and economically productive) potential is an essential part of this, but if you don’t deal with the politics — really, the power — you’ll end up with a bunch more children who fortunately have gone a lot further in their personal development, but remain stuck in or near the income decile of their birth.

As Professor Corak puts it, “Less inequality makes opportunity-enhancing policies that are of relatively larger benefit to lower-income families easier to introduce and sustain.” The inverse of this has been shown by political scientists like Larry Bartels and Martin Gilens to be a determinant factor in blocking policies that would push back against wealth concentration and supporting policies (trickle-down tax cuts, deregulation, spending cuts, reducing social insurance) that protect the highly unequal status quo. With its Citizens United decision, even the Supreme Court is in on the deal.

In my writing, I’ve identified this as the uniquely American, highly toxic combination of wealth concentration interacting with money in politics to create a vicious cycle that promotes higher inequality, less mobility, and — clearly evident in the current context — dysfunctional politics that can’t begin to do anything about either the macroeconomy or the inequality problem except make them worse.

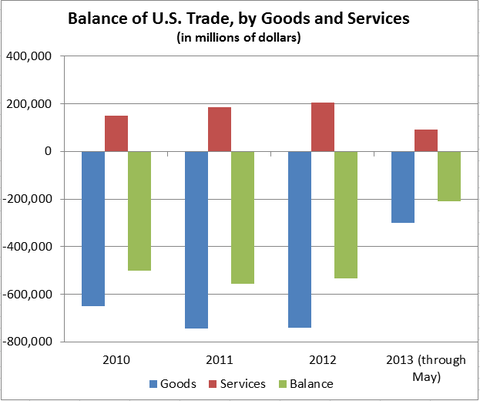

In this regard, solutions must be both political, structural (for example, campaign finance reform) and much more demand side than strictly supply side (education being the latter — and to be clear, I agree that’s a critical part of the solution). This is where the full employment policies I’m always going on about fit in, along with greater union power, higher minimum wages, financial market regulation, progressive taxation, and taking aim at the persistent trade deficit that has been sapping demand from our manufacturers for decades.

That’s a huge, ambitious agenda, one that goes so far beyond the realm of the possible that it may seem curious to even raise it. But the fact is that anything useful goes beyond what’s possible right now, and I just don’t see the point of bringing a squirt gun to a forest fire. At the very least, I’d like my fellow travelers to envision the full scope of what we’re up against.

Article source: http://economix.blogs.nytimes.com/2013/07/22/inequality-mobility-and-the-policy-agenda-they-imply/?partner=rss&emc=rss