In addition, some of those experts say demand for oil will never fully recover because of the emergence of electric cars and conservation measures.

Oil Prices: What’s Behind the Volatility? Simple Economics

The oil industry, with its history of booms and busts, has been in its deepest downturn since the 1990s, if not earlier.

“In today’s energy world, there is a distinctive clash between those who are pushing forward technologies to keep oil and gas squarely under the ground and those who are deploying capital to ensure that there is enough oil and gas if we stay with the internal combustion engine that we have today,” said Amy Myers Jaffe, director for energy and sustainability at the University of California, Davis.

“In the short term,” she said, “both sides are going to have victories but, in a long time scale, my belief is we will transition away from oil and gas.”

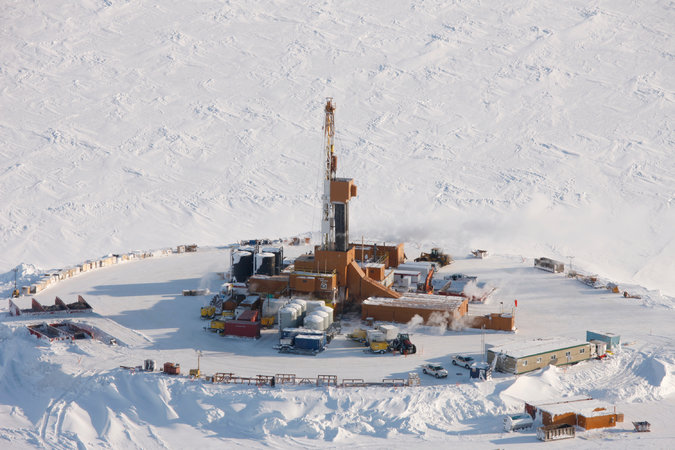

The new discoveries now fall into the center of that debate. On Tuesday, Caelus Energy announced it had found a field in the shallow waters off the North Slope in Alaska that could produce as much as 2.4 billion barrels of oil, more than half the reserves of Ecuador, an OPEC producer.

A few weeks earlier, Apache Corporation said a long-overlooked field in West Texas contained at least three billion barrels of oil and 75 trillion cubic feet of gas.

Together, the discoveries are relatively modest compared with the new-field production earlier in the decade from shale fields opened up by hydraulic fracturing — the high-pressure mix of water, sand and chemicals that blasts hard oil-bearing rocks. But some analysts say they could well be precursors to more discoveries in West Texas and Arctic Alaska.

Both companies began plowing money into exploring their prospects before the price of oil collapsed, and their new fields may have economic advantages lacking in other places. They have ample existing pipeline networks to take products to market, for example.

Advertisement

Continue reading the main story

The Caelus find is in Alaska state waters, giving the state government a strong incentive to encourage drilling to earn royalty and tax benefits and to aid the state’s slumping economy. Under Alaska law, new oil production does not have to begin to pay taxes until North Slope oil prices reach $73 a barrel — more than $20 above current prices.

Apache took advantage of the low oil prices to quietly buy 350,000 acres of drilling rights for as little as $1,300 an acre in an area that is adjacent to the giant Permian Basin oil fields but has long been overlooked. Acreage in the Permian Basin can cost nearly 40 times that much.

Apache explored its new find, called the Alpine High, at a time when it was cutting back investments in exploration and production elsewhere and selling off assets to raise cash.

“Our discovery is a testament to American ingenuity,” said John J. Christmann IV, Apache’s chief executive. “Through technology and innovation, the oil and gas industry continues to innovate and find opportunities even in mature areas like the Permian Basin.”

Caelus, a private firm backed by the private equity fund Apollo Global Management, reported that it based its resource claim on two exploration wells and 126 square miles of three-dimensional seismic testing. It said that the field could produce 200,000 barrels a day of oil, more than 60 percent of what Alaska’s giant Prudhoe Bay field currently produces.

The discovery has particular significance for Alaska, whose production has declined steadily since 1988, when Prudhoe Bay’s 1.6 million barrels a day of production was the backbone of the American oil industry. Alaska missed out on the doubling of national oil production between 2006 and 2014, a rise that resulted mostly from a drilling frenzy in shale fields in other states.

“This discovery could be really exciting for the state of Alaska,” Caelus’s chief executive, James C. Musselman, said in a statement. “It has the size and scale to play a meaningful role in sustaining the Alaskan oil business over the next three or four decades.”

The new discoveries have also reinforced the confidence within the industry that the United States will remain a major oil power — capable of producing substantial amounts for itself and exporting major quantities around the world.

“I definitely believe that finding a lot of oil is going to give us national security,” said Melvin Moran, manager of Moran Oil Enterprises in Oklahoma. “We’re not going to turn back.’’

Advertisement

Continue reading the main story

Meaningful amounts of oil will probably not be produced from the two fields for at least several years. Caelus has said that it needs to build a 125-mile pipeline, at a cost of $800 million, to attach production from its new find to existing pipelines.

Still, the two finds are good news during hard times for the industry.

Last year, American petroleum producers wrote down $177 billion in assets, according to a recent report by IHS Energy, a leading consulting firm. A new report by the international law firm Haynes and Boone noted that 102 American and Canadian oil and gas producers have filed for bankruptcy since the beginning of 2015, involving more than $50 billion in debts. As of Sept. 7, 58 producers had filed for bankruptcy this year.

The price of crude has risen in recent days, after last week’s tentative agreement among countries belonging to the Organization of the Petroleum Exporting Countries to cut output modestly later in the year.

Industry executives express skepticism that the countries will succeed in getting commitments from individual members to cut production. They add that even if there is a final agreement, cheating by many countries can be expected.

Already there are signs that Libyan exports are growing, and there is little hope that Iran will curb its production and exports now that nuclear sanctions have been lifted.

But oil executives also note that with the industry cutting investment in exploration and production by $250 billion last year, and $70 billion more this year, it is only a matter of time before demand outstrips supplies and prices rise again significantly, although not until 2018 to 2020 at the earliest. That is when more oil will need to be available, from Texas, Alaska and other places.

“You do need new discoveries to feed the supply system,” said Scott D. Sheffield, chief executive of Pioneer Natural Resources, a major Texas producer. “We have very little supply coming on.”

Continue reading the main story

Article source: http://www.nytimes.com/2016/10/06/business/energy-environment/oil-glut-here-comes-some-more.html?partner=rss&emc=rss

Speak Your Mind

You must be logged in to post a comment.