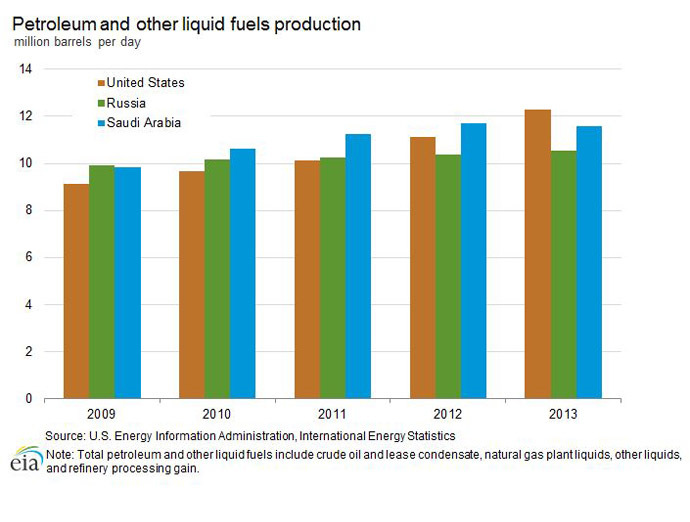

US liquefied petroleum output is set to overhaul Saudi Arabia in September or October, for the first time since 1991. In terms of crude oil production, the US is still in third, with Russia in the lead.

US production of liquid petroleum reached 11.5 million barrels

per day, on track to outpace Saudi Arabia’s 11.6 million barrels in the

next few months, according to August data from the International Energy Agency,

published on September 10.

Saudi Arabia is the second-largest petroleum exporter to the US,

but as domestic production increases in America, less is needed

from abroad.

The shale oil boom in the US began in 2008 and has increased US

crude output by 60 percent. In 2012, the United States became a

net exporter of liquefied petroleum gases for the first time.

Between January and March 2014, Saudi Arabia exported an average

of 1.5 million barrels per day to the US.

Saudi Arabia is the largest exporter of petroleum liquids in the

world and is home to the world’s largest proven crude oil

reserves, 16 percent of the world’s total.

Even though the US is poised to become the petroleum king,

Americans won’t notice a big difference at the pump. Gas prices

on average in the US are $3.34 per gallon whereas in equally

oil-rich Saudi Arabia its $0.78 per gallon.

The economy of Saudi Arabia is dependent on petroleum exports,

which accounted for 85 percent of export revenues in 2013,

according to an OPEC study. Oil and gas represent 68 percent of

Russia’s total exports.

However, in terms of crude oil production, Russia is still the

world’s leader with 10.1 million barrels per day, with Saudi

Arabia coming in second with 9.7 million barrels per day. The IEA

says the US could catch up with Saudi Arabia and Russia in crude

production by the end of the decade, but still hasn’t broken the

9 million barrel per day benchmark.

Production in Russia has fallen in recent months, and could be

hit further in the wake of sanctions, which will deprive Russian

companies of EU and US partners in Arctic, deep-sea, and shale

projects. A quarter of Russia’s total oil production depends on

shale.

The sanctions will also create problems for Western companies

like ExxonMobil, BP, Shell and others, who have joint ventures

worth billions of dollars in Russia.

Oil prices have already hit record lows this year as supply

outweighs demand due to the conflicts in Ukraine, and the Middle

East, as well as the reintroduction of Libyan production into the

market.

So far, Brent crude has fallen from about $108 a barrel at the

start of the year to about $96.50 today.

Article source: http://rt.com/business/191764-us-overtake-saudi-arabia-petroleum/

Speak Your Mind

You must be logged in to post a comment.